Understanding Candlestick

How to Read a Candlestick?

How to Read a Chart Using a Candlestick?

How to Find an Opportunity Using a Candlestick?

What is a Candlestick?

- Candlesticks are a reflection of what buyers and sellers are doing.

- Candles tell you who is in control in that specific time frame.

- Candlesticks tell us immediate information about the supply-demand relationship.

- Multiple candles form patterns that tell us a story.

- Understanding candlesticks is paramount to successfully day trade.

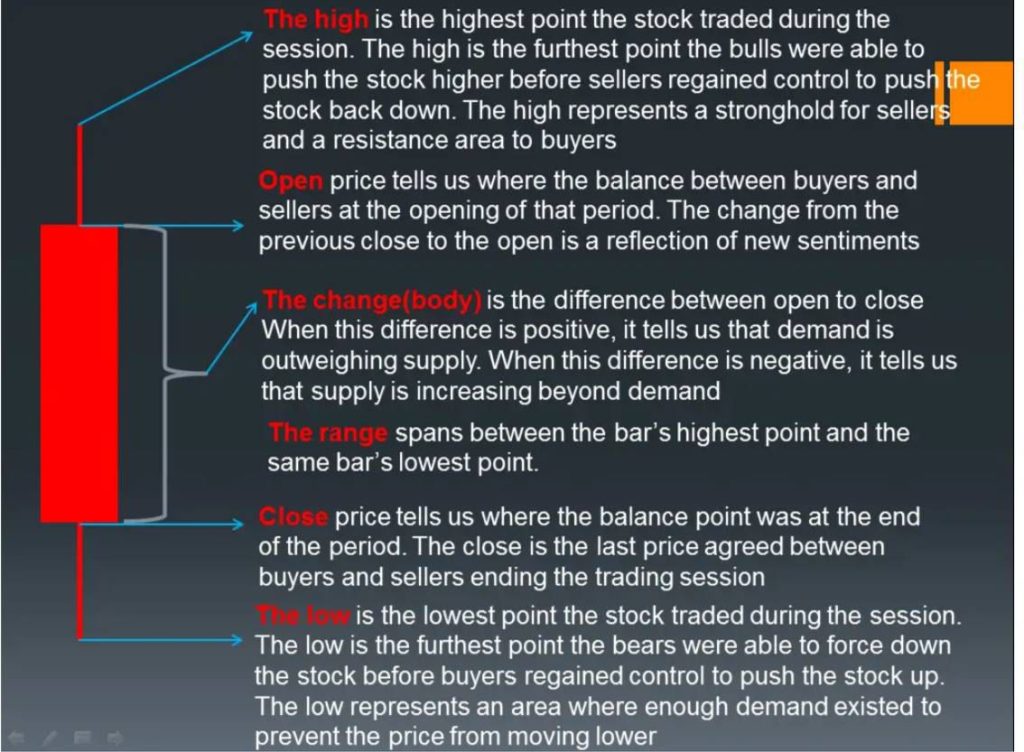

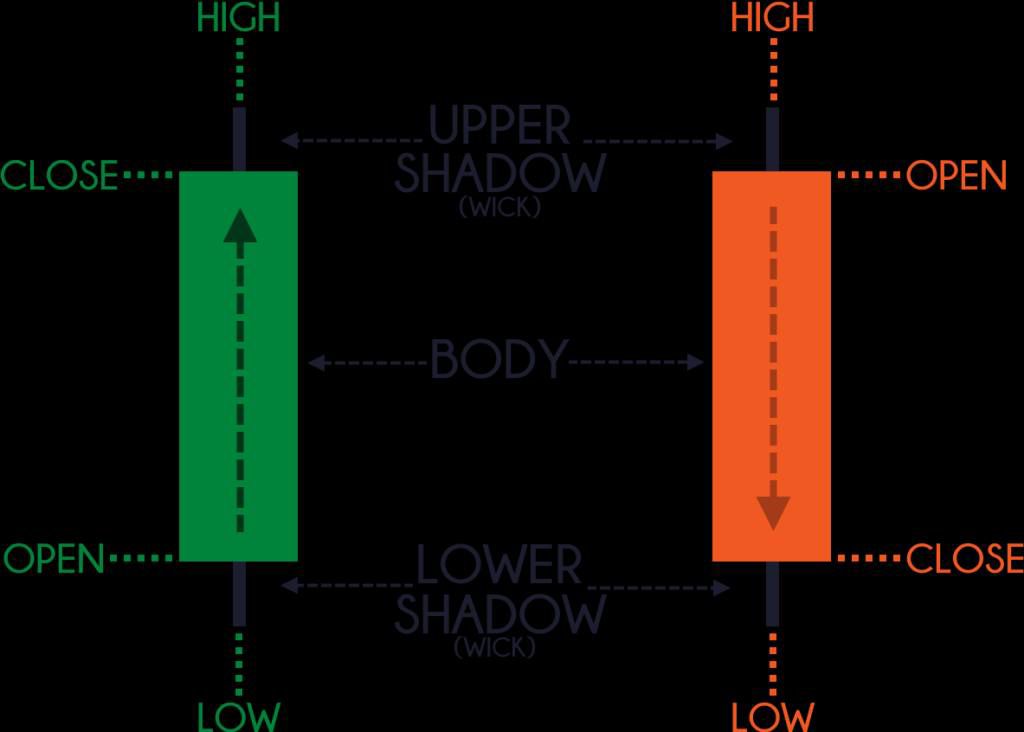

Elements of a Candlestick

- The High

- The Open

- The Low

- The Close

- The Change (BODY)

- The Range

Part 2: How to Read a Candlestick

STEP 1: The Size of the Body (Open to Close)

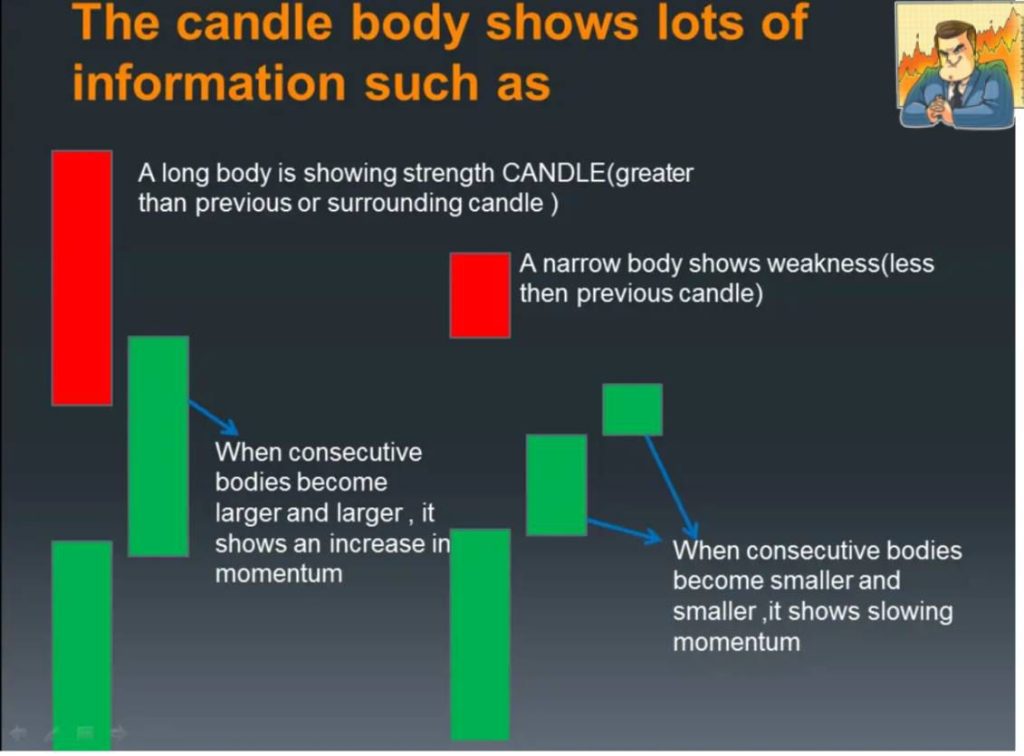

Remember that in every bar, the same number of contracts/shares are sold and bought at that time frame.

- The only reason for a bar to end up with a higher price is that the buyers were committed to one direction and more aggressive than the sellers. The reverse is true for a bear wide range bar.

- So candle body shows, to what extent they move the price and the strength behind the move.

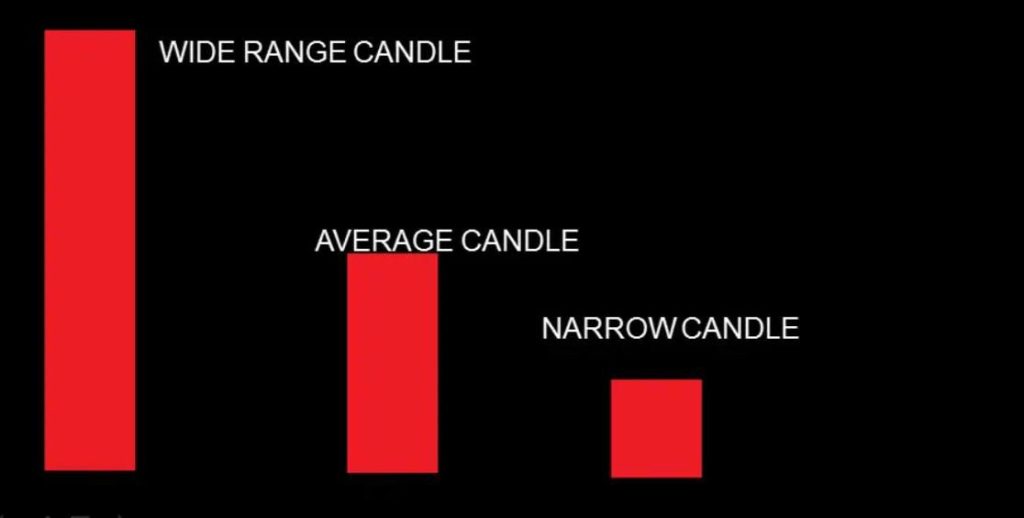

BODY:

Generally, we have to consider 3 types of body:

- Narrow range candle

- Average candle

- Wide range candle

The candle body shows lots of information such as

Let us see some example

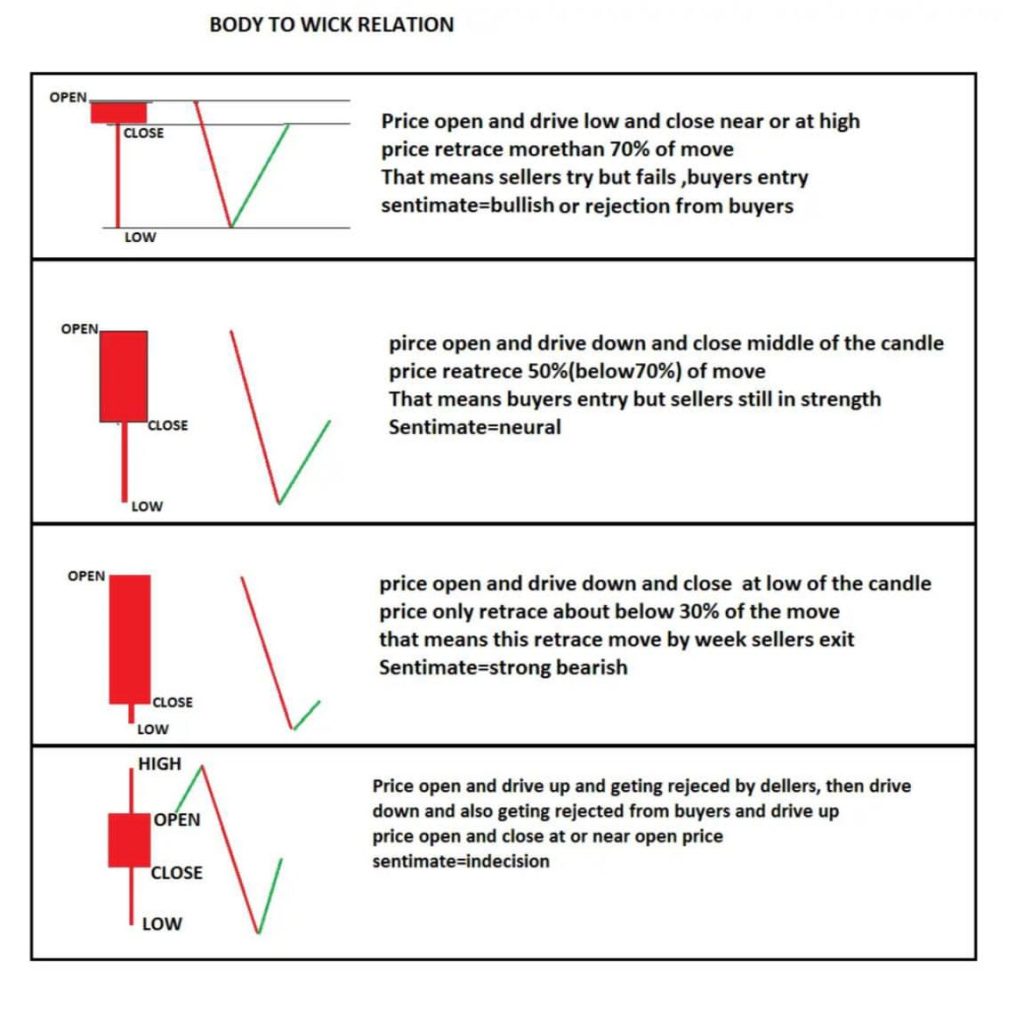

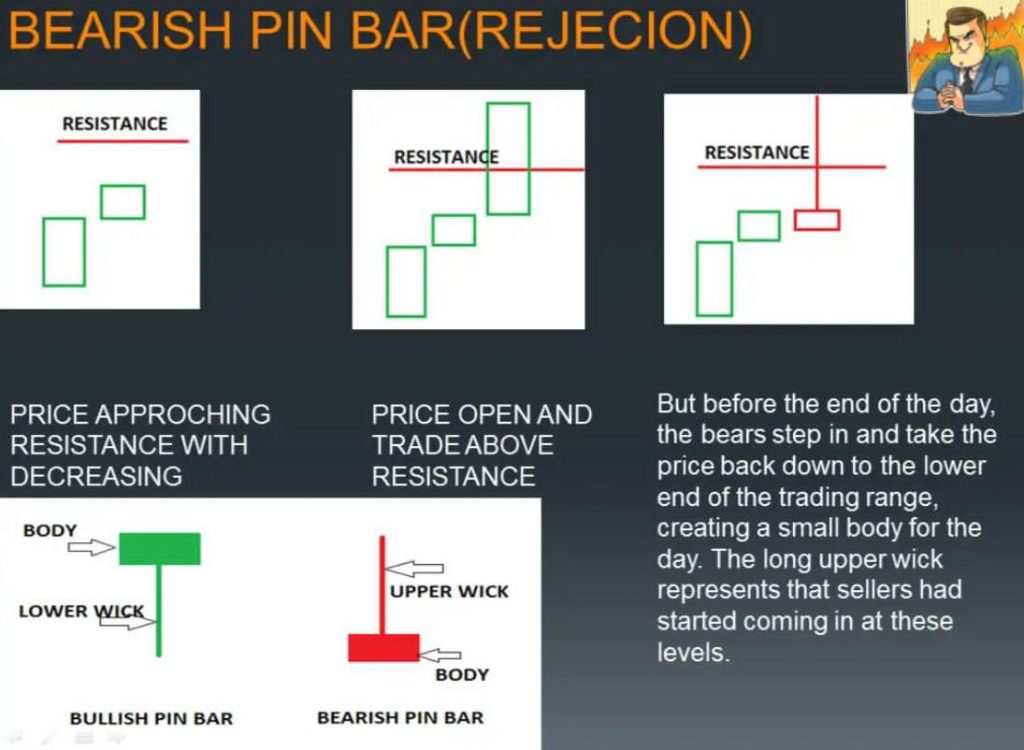

Step 2: The Length of Wicks

The length of any wick, either to the top or bottom of the candle, is ALWAYS the first point of focus because it instantly shows strength, weakness, indecision, and most importantly where SMART-MONEY enters.

- Larger wicks show that the price has moved a lot during the duration of the candle but got rejected, which indicates the presence of supply or demand.

- Lower wicks act as support and upper wicks act as resistance.

Let’s understand pin bar

What a pin bar telling us