Three Black Crows Pattern

Black Crows Pattern Candlestick patterns are the key technical tool for traders to understand the price movement of securities. The candlestick charts are most used by traders and candlesticks are formed by the open, close, high, and low prices of a security over a given time frame.

Among various candlestick patterns present, one of the most valuable candlestick pattern is “Three Black Crows”. In this article, we shall understand three black crow patterns, with their characteristics, and strategies with the help of charts.

What is the Three Black Crows Pattern?

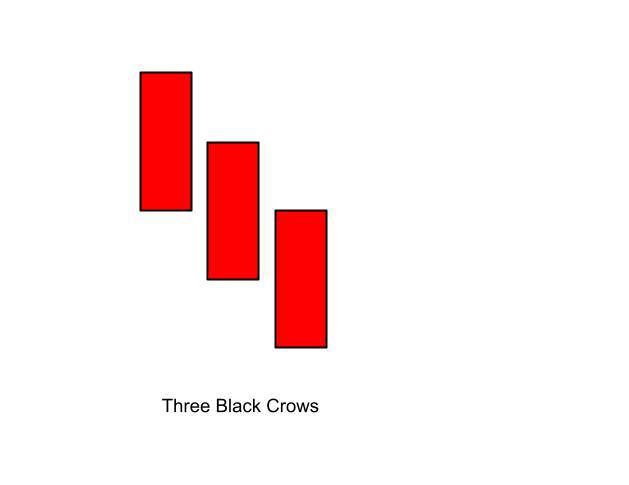

Three Black Crows is a multiple candlestick pattern that signifies the reversal of price towards the downtrend in security. It consists of three consecutive bearish long-bodied candles, where each candle’s opening price should be lower than the previous candle’s opening price.

The three Black Crows is a bearish reversal pattern that should be considered strongly when it is formed after an uptrend. The pattern formation represents a weakness in the trend signalling a potential emergence of downtrend.

Meaning Of Three Black Crows Pattern

The pattern formation signifies, that bulls were strong and winning, but now the bears have taken control and are pushing the prices lower in security. For straight three sessions, bears make new lower candles, which signals a strong trend reversal.

This continuation of the downtrend signifies the strength of bears, a short position can be initiated to ride the downtrend sentiment. The three candles look like a bearish Morubozu. It is a candlestick pattern formed with a long-bodied candle (red) with an opening price equal to high and a closing price equal to low. It indicates a bearish momentum in security.

Identifying Three Black Crows

- The prevailing trend should be an uptrend.

- There must be a formation of three consecutive long bearish candlesticks in a row.

- Each candle of the pattern must open below the previous candle’s open price.

- Each candle must close progressively downward making new lows.

- The three candles can have small or no wicks.

Trading Strategies With Three Black Crows

With a good understanding of the Three Black Crows pattern formation, let’s explore some trading strategies that can be employed.

Bearish Reversal

In a strong prevailing uptrend, the formation of the three black crow patterns indicates the end of a bullish trend. It signals a reversal and an entry to the short position can be placed.

Entry: Enter a short position in a security at the closing price of the third candle of the pattern formed.

Stop loss: The stop loss is simple for the pattern, the high price of the pattern formed can be set as a stop loss for the good risk reward.

Profit Target: This pattern has the potential of giving high risk to reward trades with the minimum target being the first level of support.

Chart of Infosys Ltd showing the formation of Three Black crows pattern.

Trend Reversal

The pattern formation helps traders spot technical exits to the long position placed in security. While spotting an entry is of paramount importance, an exit is also very important.

After a strong uptrend, the formation of the three black crows pattern indicates a reversal of the previous trend.

Hence, traders prefer to square off the existing long position with the confirmation of three black crows pattern formation.

Traders can also confirm the formation of a pattern with other strategies to spot the trend reversal.

Three Black Crows With Moving Average

The three black crows pattern is combined with a short-term moving average as a confirmation to avoid false signals generated by the pattern. When the price of security forms the three black crows, it indicates a sign of reversal. As we know one can enter a short position, to confirm the entry we shall apply the moving average.

When the price closes below the moving average, as a double confirmation from the pattern and moving average, one can place a short position for a good risk-to-reward trade. In the below chart, it can be observed that the chart of Reliance Industries shows the confirmation of a downtrend with pattern formation and the price below the 5 EMA.

Chart of Reliance Industries showing a combination of pattern and moving average.

Limitations Of Three Black Crows

While the Three black crows is a powerful reversal signal, it is not reliable, and traders should be aware of its limitations:

- If the pattern flops, then the potential of loss is big as the stop loss is above the pattern.

- The effectiveness of the pattern may vary depending on market conditions, it can be more reliable in trending markets than in range-bound markets.

- Formation of pattern in daily, weekly, and monthly time frames are expensive to trade.

- The pattern takes three consecutive sessions (or candles) to form which can lead to late entry.

In Closing

The three black crows are a strong tool for traders to identify potential bearish reversals in the security. Understanding its formation, strategies and limitations, helps traders to make informed trading decisions.

As a trader, it is always preferred to use the pattern in conjunction with other technical tools to avoid false signals. Proper risk management with good risk-reward ratios and backtesting make a trader profitable in the long run.